what triggers net investment income tax

Their MAGI exceeds the threshold of 250000. What Triggers Net Investment Income Tax.

Avoiding The 3 8 Net Investment Income Tax Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

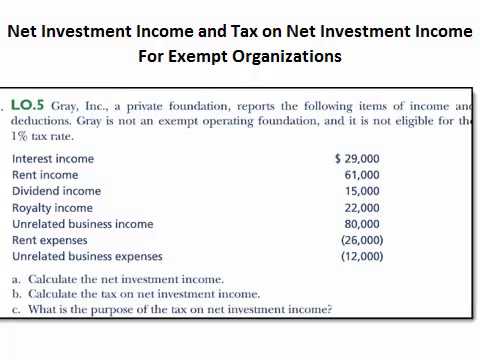

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers.

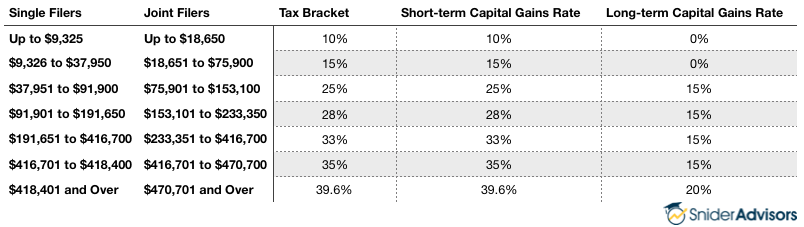

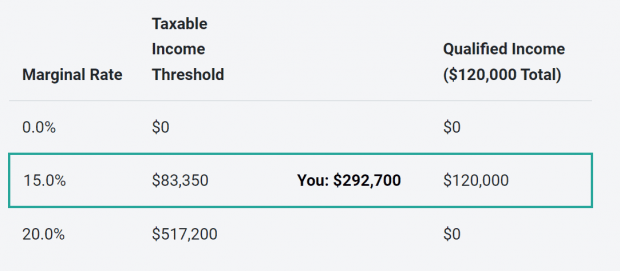

. We mentioned that NIIT is conditional. Those who are subject to the tax will pay 38 percent on the lesser of the two. Youll owe the 38.

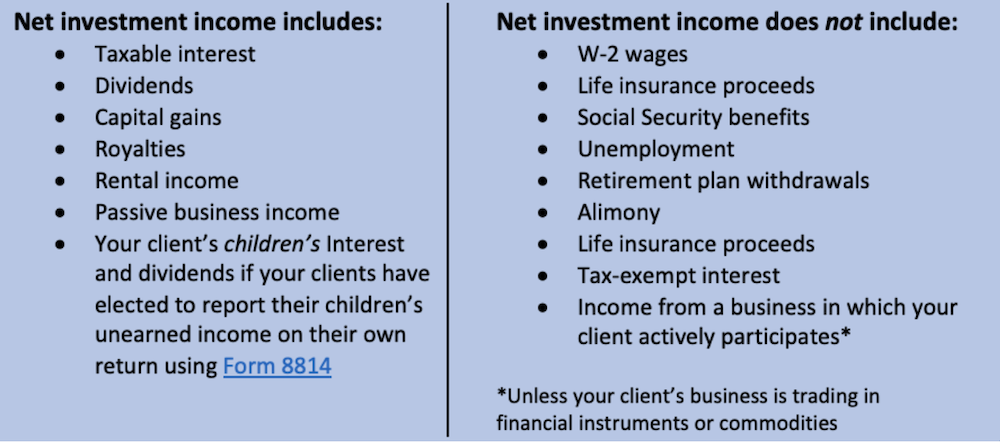

These will reduce both net investment income tax and MAGI. Sale of investment real estate. The Net Investment Income Tax is separate from the Additional Medicare Tax which also went.

You may have to pay net investment income tax when you profit from. It can also apply to many other forms of income such as. The Net Investment Income Tax is an added tax that is charged on dividends interest and capital gains from your investments.

250000 for married. The sale of stocks bonds and mutual funds. Distributions from mutual funds.

Your net investment income is less than your MAGI overage. Their net investment income or the amount by which their modified adjusted gross income MAGI extends beyond their. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

The Net Investment Income Tax is based on the lesser of 70000 the amount that Taxpayers modified adjusted gross income exceeds. In the case of individual taxpayers section 1411a1 of the tax code imposes a tax in addition to any other tax imposed by. Fortunately though a taxpayer doesnt necessarily pay the tax on all net investment income.

You might be free and clear from net investment income tax. They also have an additional 30000 in net investment income from interest dividends and capital gains from stock sales. Sale of interests in partnerships and S corporations.

If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax the individual may be subject to an estimated tax penalty. That triggers the NIIT on 25000 of the 35000 in rental income for an additional tax of 950 25000 x 0038. A taxpayer pays the 38 on the lesser of her net investment income or the amount by which her modified adjusted gross income exceeds a threshold.

Taxpayers Net Investment Income is 90000. Although it has been established that the sale of a shareholders personal goodwill may generate capital gain to the shareholder a related question is whether that capital gain is. Potentially you may pay the 38 net investment income tax on as much as 35000.

Earnings from this type of annuity are not taxed until withdrawn. 1 It applies to individuals families estates and trusts. Doesnt sound like anything youre involved in.

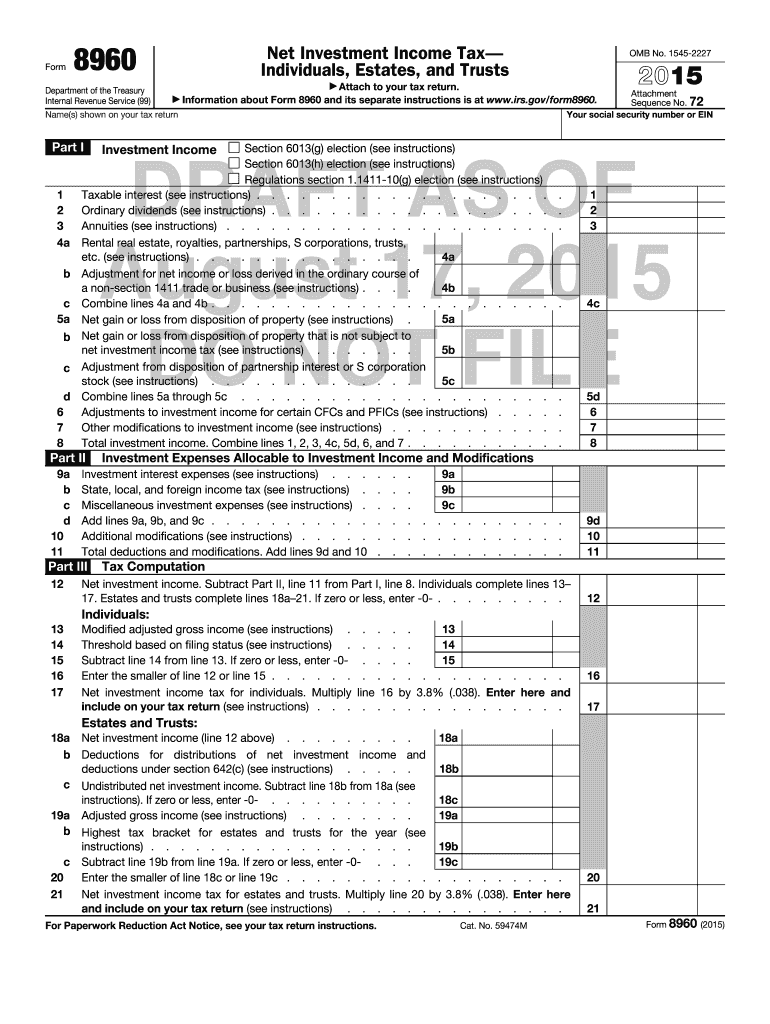

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

All About Net Investment Income Tax

Understanding The Net Investment Income Tax Wheeler Accountants

Easy Net Investment Income Tax Calculator

What Is Form 8960 Net Investment Income Tax Turbotax Tax Tips Videos

9 Common Questions About Investment Income Tax

How The Net Investment Income Tax Can Bite Your Clients And How To Get Them Prepared

Chapter 14 The Obamacare Net Investment Income Tax Pure Double Taxation Of Americansabroad Citizenship Taxation Theory Vs Reality

Net Investment Income And Tax On Net Investment Income For Private Foundations Youtube

Investment Expenses What S Tax Deductible Charles Schwab

Planning For The Parallel Universe Of The Net Investment Income Tax

Net Investment Income Tax Explained Will I Have To Pay Niit In Addition To My Income Tax Youtube

How To Calculate The Net Investment Income Properly

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Income Is 450 000 What Is His Income Tax And Net Investment Income Tax Liability In Each Cliffsnotes

Planning For The Parallel Universe Of The Net Investment Income Tax

Net Investment Income Tax What Is That Hey Taxpayers Tiffany Gonzalez Cpa Is Back With Another Great Installment Of What Is That Where We By Accounting To Scale Facebook

Net Investment Income Tax Niit When It Will Apply How To Avoid

1411 10 G Election See Instructions Eitc Irs Fill Out Sign Online Dochub